Industry Update – August 2023

This week we highlight the new Panama Canal drought restrictions and some important upcoming milestone dates for key union contracts.

ILWU and UPS Tentative Contracts up for Vote by Members

- Voting to ratify the tentative contract agreement between the ILWU and the PMA began on August 15 and will continue until August 17th. The tentative 6-year contract is expected to gain enough votes to be ratified by ILWU members.

- Meanwhile, Canada ILWU voted on August 4th to ratify a four-year contract agreement with the British Columbia Maritime Employers Association.

- Settling both of these labor disputes will improve importer confidence in the stability of West Coast port operations.

- UPS negotiated a new contract with their union employees averting a potential strike action. Voting on the new contract will end on August 22nd and is expected to be ratified by union members.

Panama Canal Drought Restrictions Limit Reservations

- Drought restrictions have reduced the number of ships allotted to pre-book passage via the Panama Canal. The Panama Canal Authority has stated: “In response to the unpredictable weather patterns and the need to ensure reliable and sustainable service, the authority aims to maintain a draft of 44 feet or 13.41 throughout the remainder of the current year and part of 2024, unless significant changes occur in weather conditions from current projections. Consistent with this draft, during this period, 32 vessels per day will be transiting the Canal, down from an average of 36 in normal circumstances. It is worth noting that Neopanamax transit capacity will remain largely unchanged at an average of 10 daily transits.”

- Effective August 8th, the PCA announced a new booking condition which limits the number of slots to just 14 per day for super-sized vessels. Reservations for Neopanamax locks remain unchanged.

- The new Booking Condition has resulted in an increase in the number of vessels waiting to transit. Only 38% of vessels waiting to transit have reservations. The remaining 62% must wait to proceed across the canal.

- Because of the lower draft restrictions some vessels must be lighter in order to maintain the draft requirement needed to transit safely.

- Ongoing issues with Panama Canal routing may motivate importers to consider alternate routing if possible. For example, freight destined for the US East Coast originating in the ASEAN and some Southern China regions may choose to utilize the Suez Canal as an alternate route.

Selected U.S. Market Metrics

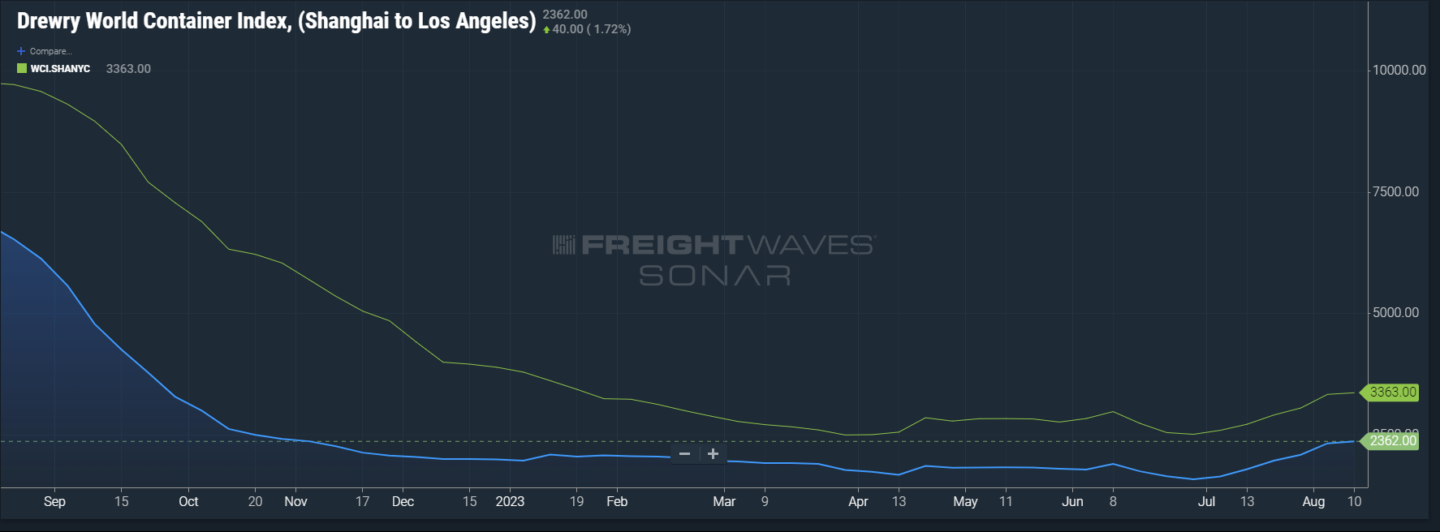

- Ocean: Chart below illustrates past 1 year 08/15/22 – 08/15/23 of rate fluctuation comparing SHA to LAX and SHA to NYC.

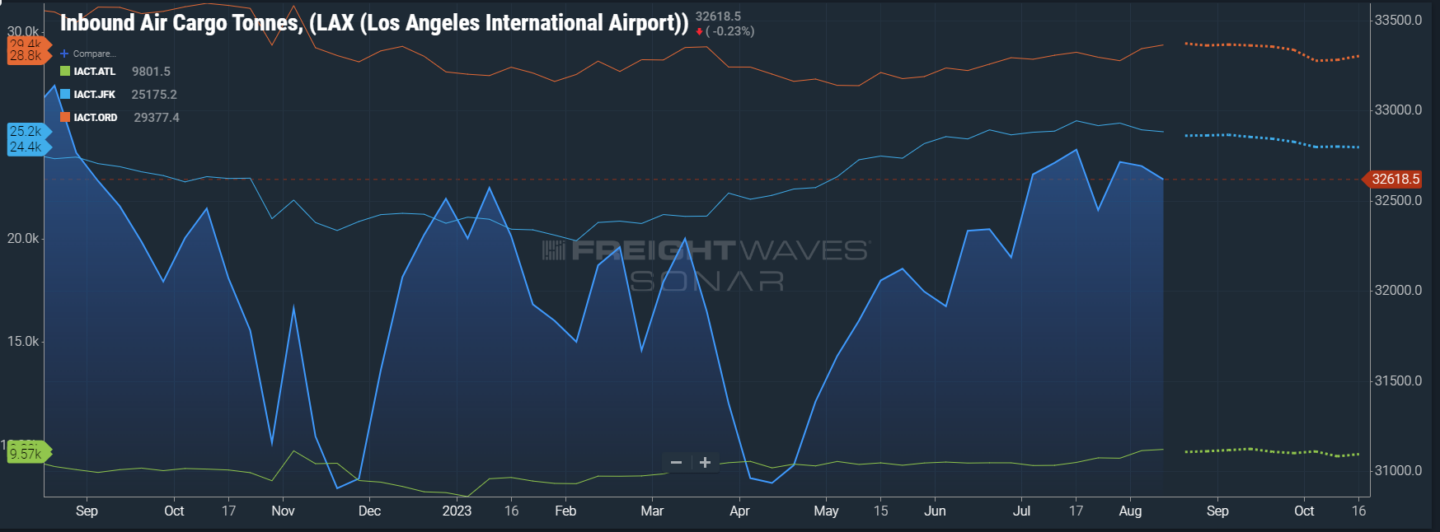

Air: Below chart illustrates past Inbound Air Cargo Tonnes: 1-year (08/15/22 – 08/15/23) rate movement. Dotted line illustrates next 7 days out based on predictive booking. LAX JFK ATL ORD

40’ Container Rate Index Movement

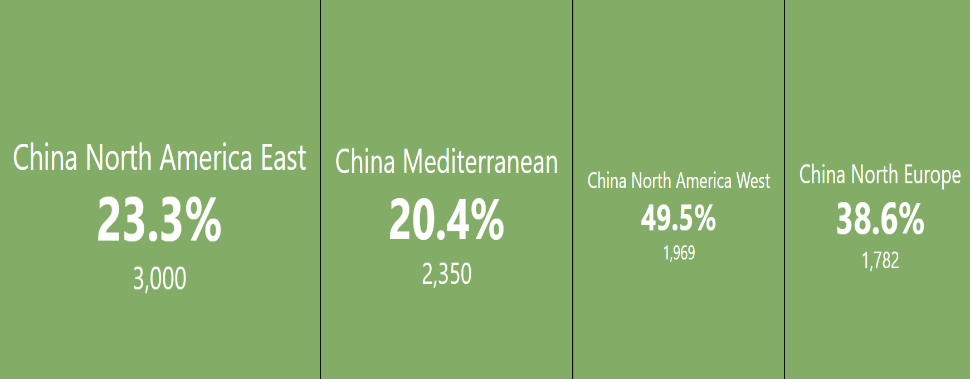

Chart illustrates the percentage of change in rate up/down for the past month along with the Value (rate level based on regional international trade data. The Freightos Baltic Daily Index measures the daily price movements of 40-foot containers in 12 major maritime lanes. It is expressed as an average price per 40-foot container.

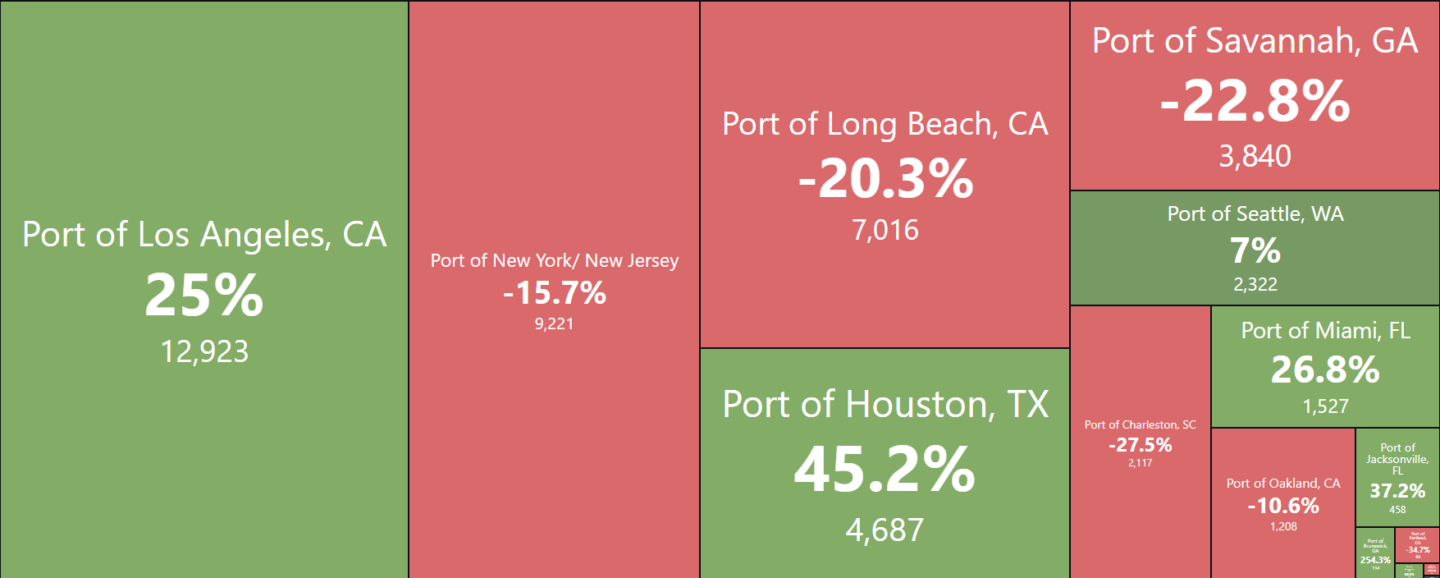

Chart illustrates the percentage of increase/decrease in volume for that port Year over Year. The whole number indicates the total number of import shipments (containerized and non-containerized).